The rent freeze is being extended

In the coalition agreement’s ‘Tenant protection’ section, the new federal government has set out the renewal of the rent-freeze regulations and extended these until 2029. Furthermore, it has been decided that

- rent may only be increased by a maximum of 11% within three years. Qualified rent indexes are to be reinforced, expanded and made more legally binding.

- the period of the tenancy agreements used to calculate the rent index is to be extended to seven years.

- invoices for service charges must be made more transparent. [1]

The reformed rent-index legislation comes into force on 1 July 2022. The reformed law stipulates a uniform set of rules for the creation of qualified rent indexes. Data affecting the rent index are collected on a regular basis via surveys. Participation in this survey is mandatory for both tenants and landlords.

The right of first refusal in social conservation areas in parts of Berlin has been partially overturned

On 9 November 2021, the Federal Administrative Court ruled that the actual circumstances need to be considered when assessing the right of first refusal in social conservation areas. A mere presumption that the buyer wishes to drive tenants out of their neighbourhood is not sufficient for the granting of a right of first refusal.

The judges decided that no right of first refusal exists when the site is being developed and used in accordance with the aims or purposes of the city’s urban development measures and when a building constructed on said site does not evince any faults or defects pursuant to § 177 Paras 2 and 3 lit 1 of the Federal Building Code (BauGB).[2] With this verdict, the Berlin practice of exercising the right of first refusal has been largely overturned. This should result is a strong decline in the number of cases in which the right of first refusal is exercised or in which a forestalment agreement is signed. FYI:

In 2019, there were 27 instances of a right of first refusal and 61 forestalment agreements in total. In 2020, there were 18 instances of a right of first refusal and 143 forestalment agreements.

Expropriation of large corporate landlords

In addition to the Bundestag and senate elections, September also saw the holding of a referendum. With this referendum, the ‘Expropriating Deutsche Wohnen & Co’ initiative is seeking the creation of legislation that allows the senate to expropriate corporate landlords in possession of more than 3,000 apartments. A majority of 57.6% voted in favour of this proposal in the referendum.[3]. The new government will appoint an expert commission in the next two and a half months. Its first aim will be to examine whether such a law is constitutional. Should the findings of this examination allow it, the requisite draft legislation is to be submitted in 2023. The senate has the final say on this legislation. Ultimately, it will be for the Federal Constitutional Court to decide whether or not the adopted approach is constitutional.[4].

Creating more housing is a key aim of both coalition agreements

According to the federal government’s coalition agreement, a home is a fundamental need. In order to meet this fundamental need, the new federal government wishes to build 400,000 (100,000 publicly funded) apartments a year.

It its coalition agreement , Berlin’s local government sets out its ambition to build 20,000 new apartments a year in the city.

Funds will be set up to help more people acquire a home. To this end, the federal government is to issue loans that replace buyers’ deposits, among other things. In addition, so-called ‘threshold households’ – i.e. households that cannot purchase a property without funding[5]– are to be provided with long-term support, such as repayment subsidies and reduced interest rates.[6] Ancillary purchase costs are to be reduced by amending the land tax.

Changes to the land tax

The federal government is planning to amend the land tax in order to reduce the ancillary costs of purchasing a property. The aim is to create incentives to make purchasing a property more attractive and increase the level of home ownership. To this end, federal states are to be given the power to amend the land tax or create tax thresholds. The land tax represents a substantial proportion of the ancillary purchase costs, as many federal states have a taxation rate that extends to the top limit of 6.5%. Berlin’s land-tax rate is currently at 6%. Whether the new government in Berlin will seize this opportunity and create incentives remains to be seen.

The cost of such changes to the land tax or the introduction of tax thresholds is to be covered by closing tax loopholes in so-called share deals. Such share deals are generally exempt from land tax, as they involve the purchase of shares in a company rather than the direct purchase of property. The local government is to put an end to this and use the additional money thereby generated to cover the cost of introducing tax thresholds

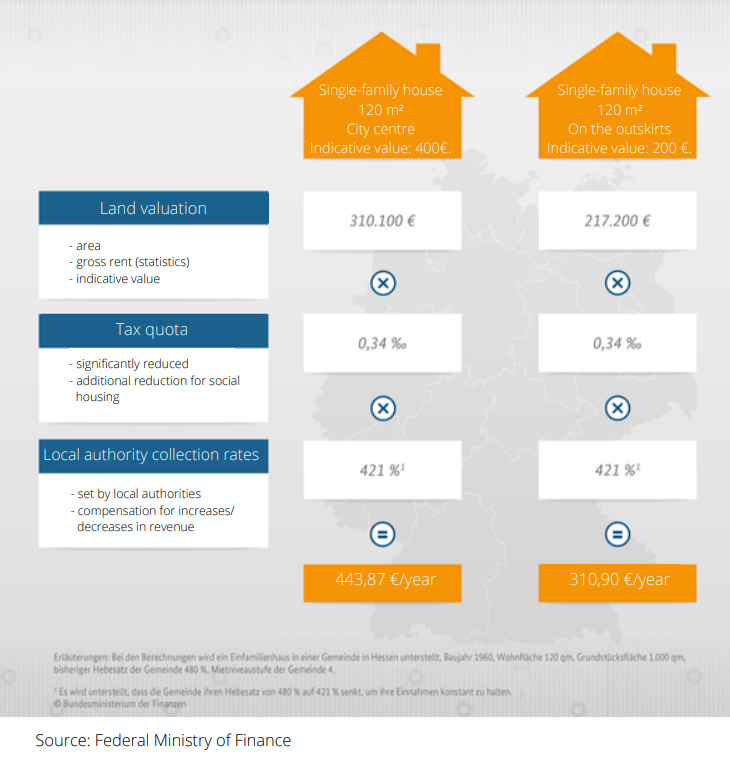

New regulations have been introduced for the property tax.

The reformed property tax ordinance introduced on 26 November 2019 sets out a change to the levying of the property tax. This was necessary, as the Federal Constitutional Court had ruled that the previous practice based on a uniform assessment was unconstitutional. From 1 January 2025, the property tax will be calculated using new property-tax criteria. In future, the new property tax will be calculated based on the value of the property.[7][8] The calculation will be based on the property values as they stand on 1 January 2022. To this end, property owners will be asked to provide a variety of information, such as the property’s location, indicative land value, size, building type, living space, share of co-ownership, and year of construction.[9]

[10]

In order to provide the requisite information to the financial authorities, property owners must submit a tax declaration by 31 October 2022. However, the necessary assessment returns are not yet universally available. Yet Berlin wishes to provide the necessary returns in good time. From 1 July 2022, property owners will have the opportunity to submit the appropriate assessment returns and are obligated to do so by 31 October 2022.[11]

There is to be a crackdown on money-laundering

The possibilities for illegally funding property purchases are to be closed off. In future, proof of tax payments will need to be submitted for each property purchase conducted from abroad. This applies to both private and commercial purchasers. Cash payment of the purchase price is to be banned. [12]

A certificate of competency is to be introduced for estate agents and administrators

In future, anyone wishing to practise as an estate agent or administrator must prove their expertise and abilities via certification. As the administration and brokerage of assets/properties entails considerable responsibility, certification of the requisite expertise and experience is important. This ensure that consumers are afforded the necessary protection. The introduction of a genuine certificate of competency is intended to guarantee the necessary professionalism.

In future, cable charges are no longer to be passed on to tenants

The amendment to the Telecommunications Act is to be accompanied by a strengthening of tenancy law. In future, landlords will no longer be able to pass on the costs of cable connections to tenants. Tenants are thus going to be given a choice as to what kind of connection they desire.

This regulation applies for connections set up after 1 December 2021. For existing properties, the regulation will come into effect from 1 July 2024.[13]

In future, tenants are to be informed of heating costs and consumption on a monthly basis

The new heating costs ordinance came into force on 1 December 2021. In this context, there is a strong focus on building/heating technology that can be read off remotely. With the introduction of the new ordinance, newly installed meters for heating systems and other buildings technology must be capable of being read off remotely. All older devices must be replaced by the end of 2026.

Where such remotely readable meters have already been installed, the owner is obligated to provide tenants with information on invoicing and consumption on at least a monthly basis.

If you are looking for a different topic or still have questions, please get in touch with us.

Tel: + 49 03 61 67 51 15

E-mail: co*****@ad*******.com

Sources:

[1] https://www.bundesregierung.de/resource/blob/974430/1990812/04221173eef9a6720059cc353d759a2b/2021-12-10-koav2021-data.pdf?download=1

[2] https://www.bverwg.de/pm/2021/70

[3] https://www.haufe.de/immobilien/wirtschaft-politik/berlin-debatte-um-enteignungen-geht-weiter_84342_487722.html

[4] https://www.berlin.de/rbmskzl/regierende-buergermeisterin/senat/koalitionsvertrag/

[5] https://www.ifsberlin.de/data/_migrated/news_uploads/F16_Lang.pdf

[6] https://www.bundesregierung.de/resource/blob/974430/1990812/04221173eef9a6720059cc353d759a2b/2021-12-10-koav2021-data.pdf?download=1

[7] https://ivd.net/2021/02/bundestag-entscheidet-ueber-reform-der-grundsteuer/#:~:text=2019%20neu%20zu%20regeln.,auf%20den%201.1.2025%20angeordnet.

[8] https://www.berlin.de/sen/finanzen/presse/pressemitteilungen/pressemitteilung.1035646.php

[9] https://www.berlin.de/sen/finanzen/steuern/informationen-fuer-steuerzahler-/faq-steuern/artikel.9031.php#headline_1_15

[10] https://www.bundesfinanzministerium.de/Content/DE/FAQ/2019-06-21-faq-die-neue-grundsteuer.html

[11] https://www.datev.de/web/de/aktuelles/grundsteuerreform/aufgaben-fuer-kanzleien/

[12] https://www.bundesregierung.de/resource/blob/974430/1990812/04221173eef9a6720059cc353d759a2b/2021-12-10-koav2021-data.pdf?download=1

[13] https://www.haus-und-grund-vertrag.de/telekommunikationsgesetz_06-2021.html#:~:text=Vermieter%20k%C3%B6nnen%20die%20Kosten%20f%C3%BCr,der%20Novelle%20des%20Telekommunikationsgesetzes%20beschlossen.&text=Dezember%202021%20errichtet%20worden%20sind,auf%20die%20Mieter%20umgelegt%20werden.

Legal note: This article does not constitute tax or legal advice in individual cases. Please have the facts of your specific individual case clarified by a lawyer and/or tax advisor.