Berlin – a city of possibilities

Berlin is a modern, dynamic metropolis with international pulling power. The break-neck pace of development here over the past three decades is reflected in the diametric contrast of challenges and opportunities. The charm of Germany’s prosperous capital city lies in its tolerance, openness and cultural diversity. This once-divided city has long since made up the deficit in its competition with international European cities such as Vienna, Paris and London.

Berlin stands out thanks to its central location in the heart of Europe. As a political hub with a turbulent history, Berlin is a symbol of Germany’s political reunification. The city is the seat of the national government; the centre of numerous organisations, associations and media companies; the home of many academic, cultural and administrative institutions; and a place where business, politics and culture come together. Berlin is a magnet for the creative industries and the information and communications sector.

For years now, the number of people in employment has been growing faster in Berlin than the national average. Purchasing power is still below the national average currently yet contains enormous potential. The current population forecasts predict that the figure will grow to 3.925 million inhabitants by 2030.

Berlin is drawing attention to itself – with spectacular projects: Berlin Brandenburg Airport is finally operational; Siemensstadt 2.0 in Spandau is unlocking new opportunities; Potsdamer Platz is being redeveloped; and Alexander Tower, a 150-metre-tall residential high-rise in the immediate vicinity of Berlin’s Alexanderplatz by the Alexa department store, will soon be demonstrating the city’s direction of travel – upwards. Slated for completion in 2023, the building will be Berlin’s tallest residential building and one of the tallest in Germany.

The property market continues to break records. Though the effects of the pandemic were also felt in Berlin, interest in property is still lively while supply remains limited. According to the Berlin Senate, the city’s housing requirements will stand at 20,000 homes a year by 2030. The construction boom of recent years can barely keep pace with demand.

Yet there are also obstacles in the way: controversial discussions over social conservation areas, rent freezes and rent caps are creating uncertainty. Though the Federal Constitutional Court overturned the rent cap, some investors initially remained hesitant.

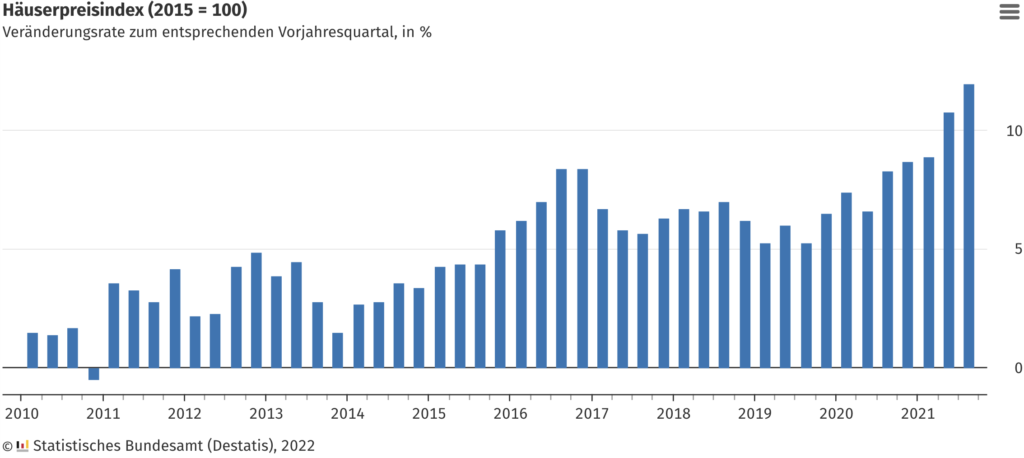

Prices for residential property in Germany in 2021

The graph published by the Federal Statistical Office clearly shows how the price of residential property has developed in Germany. In the third quarter of 2021, it rose by an average of 12.0 per cent on the same period in the preceding year. This is the second consecutive largest price increase in residential property transactions since records began in 2000. The price of apartments as well as detached houses and multi-dwelling units rose by an average of 4.2 per cent on the previous quarter.

House price index (2015 = 100)

We can observe a particularly strong price increase in the TOP SEVEN cities of Berlin, Hamburg, Munich, Cologne, Frankfurt, Stuttgart and Düsseldorf. Here, the prices for detached houses, multi-dwelling units and private apartments rose by 14.5 per cent on the same quarter in the preceding year.

2021 property market report from the assessors associations

Together with the Federal Office for Building and Regional Planning (BBSR), the working group of the official assessors associations has submitted its 2021 report on the German property market. According to this report, the residential property market has remained unaffected by the coronavirus crisis. Investment in the acquisition of property doubled between 2010 and 2020. The year saw another record-breaking turnover of EUR 310 billion, though this was considerably less than in previous years. Whereas the residential property market continues to boom, the market for commercial properties is less bullish. Around three-quarters of all property purchases made in 2020 were residential. In 2015, the proportion was just under two-thirds. Compared to the previous year, investment in the acquisition of residential property rose by 7 per cent.

In the category of previously occupied detached houses and multi-dwelling units, buyers in the Munich administrative district spent the most, with an average EUR 11,220 per square metre of living space. The national average in 2020 was EUR 2,140 per square metre. This was 80 per cent more than in 2010, when it was EUR 1,190.

The danger of property bubbles is increasing regionally

There is excessive speculation in ever more regions and price segments, especially when it comes to private apartments and building plots in cities such as Berlin, Hamburg and Munich. These cities – but other major cities too – may see larger-scale price corrections in the coming years. This is the conclusion of property economists Konstantin Kholodilin and Claus Michelsen in a recent study published in the weekly newsletter of the German Institute for Economic Research (DIW Berlin).

For this study, the two economists analysed data from IVD, Germany’s professional association of estate agents, in order to examine developments in Germany’s 114 largest cities with at least 50,000 residents. They took account not only of purchase prices for private apartments and houses, but also of rent prices. Whereas purchase prices for private property increased by an average of 9 per cent this year, rent prices went up by only around half as much. Given that property prices should be linked in the long term to the development of rent income and thus to general developments in income levels, an increasing disparity between rent prices and purchase prices is indicative of speculation bubbles.

Empirica property price index shows record values

The empirica research institute regularly publishes the empirica property price index, the empirica bubble index and the empirica affordability index.

According to these, the indexes for tenanted and owner-occupied apartments as well as for detached houses and multi-dwelling units have increased on average for every year of construction – by 2.9 per cent on the previous quarter for owner-occupied apartments, and by as much as 3.1 per cent for detached houses and multi-dwelling units.

With an increase of 1.2 per cent on the previous quarter, rent prices once again showed considerably weaker growth compared to owner-occupied apartments and detached houses.

Over the same period, the indexes for newly built apartments/detached houses and multi-dwelling units reached record values: the number of owner-occupied apartments grew by 2.6 per cent, and new-build detached houses by 3.3 per cent. At 1.0 per cent, the growth in new-build tenanted apartments was once again the lowest.

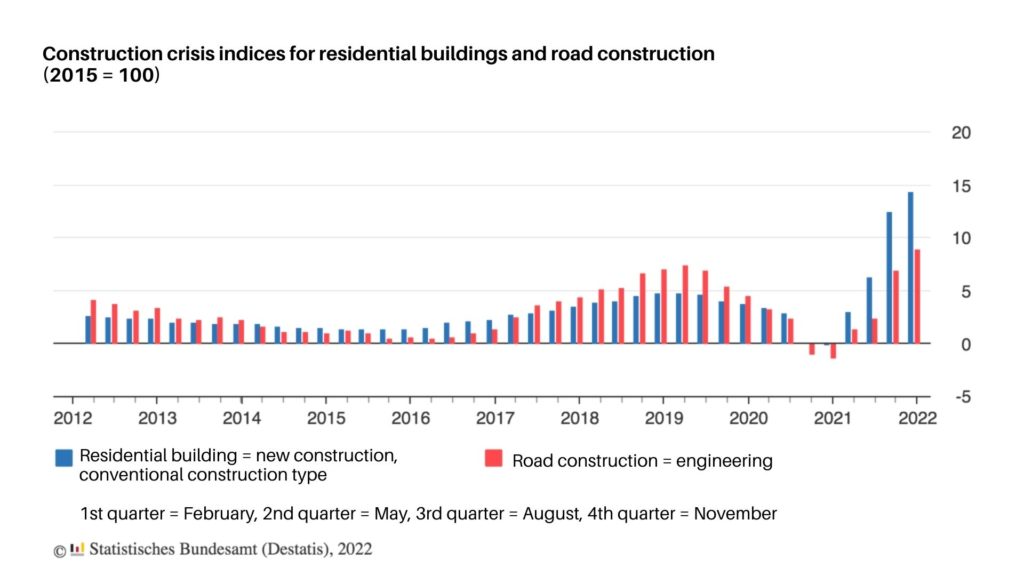

Steepest growth in construction costs since 1970

A few years ago, building one’s own new house was still regarded as a viable alternative to purchasing a previously occupied house or an older private apartment. In the interim, however, construction costs have risen so steeply that this option is only open to developers with considerable financial reserves.

Construction price indices for residential buildings and road construction (2015 = 100)

According to the data published by the Federal Statistical Office, in November 2021, the cost of construction of new residential buildings in Germany rose by 14.4 per cent compared to November 2020. This is the steepest year-on-year increase in construction costs since August 1970.

Property price development: Berlin as a unique case

The 2020/2021 Berlin property market report from the assessors association highlights the unique characteristics of the property market in Berlin. The median purchase price for a private apartment is now at EUR 4,735 per square metre and has thus increased by 6 per cent on the previous year. The Berlin tenants’ association decries what it regards as a political failing: ‘A household with an average income must spend around 15 times its annual net salary to purchase an 85-square-metre private apartment. (…) 45 per cent of Berlin households only have a monthly income of less than EUR 2,000.’ Demand currently extends far into the surrounding areas, predominantly in regions with good transport links to the capital city.

Compared to other major German cities, the property market in Berlin is still strongly defined by the political and economic developments resulting from Reunification. Whereas cities such as Munich, Frankfurt and Hamburg were able to develop continuously over decades, Berlin was in effect catapulted out of its formerly constrained situation. To this day, this unique dynamic is reflected in the figures.

The city’s exceptional situation can also be seen in the demand for property. According to the property portal ImmobilienScout24, for every property advert in Berlin, there are two enquiries per week for every new-build house advertised (in Germany as a whole, the number is one); five enquiries for every previously occupied house advertised (four in Germany as a whole); one enquiry per week for every new-build private apartment advertised (the figure in Germany as a whole is also one); and three enquiries per week for every previously occupied private apartment (five in Germany as a whole).

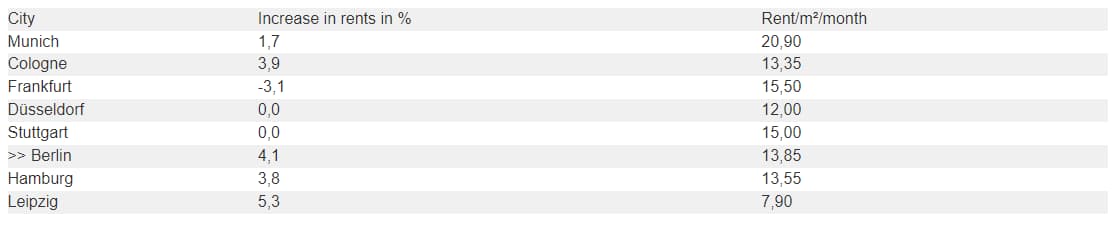

A waning rent and price dynamic

Whereas the price dynamic of the housing market in major cities is cooling off a little, the surrounding areas are now catching up. According to data on rent prices published by JLL Research, Leipzig was the only market among the Big Eight cities (see table) able to achieve higher growth in 2021 than in the five-year comparison. In Berlin, the comparatively strong increase is the result of the courts overturning the rent cap. The strong dynamic of rent price development in the Big Eight cities and other major cities in recent years is waning, while peripheral areas are catching up.

JLL Research, Angebotsmieten Q2 / Q1 -2021

The purchase prices for private apartments in the Big Eight cities increased further in 2021, though the dynamic is waning in the top segment. Compared to the five-year average, there was robust growth in some areas, with an average of 11.4 per cent. In the major cities outside the Big Eight, the current annual growth rate is on average 12.5 per cent. The price dynamic in peripheral areas is developing in similar fashion to that in the major cities.

JLL Research

Outlook for future property price developments

Overall, the price dynamic of private apartments and houses offered for purchase continues to grow, though displaying differences by region and location.

Owing to the enduring demand and increased construction costs, ImmoScout24 predicts that the asking price for private apartments will increase by 13 per cent nationally in the coming 12 months. In the major cities, the percentage increase on prices is not growing as steeply as in the other regions of Germany. The greatest price increases are predicted to occur in Frankfurt am Main with 11 per cent, followed by Berlin, Düsseldorf and Cologne at 9 per cent each. However, the asking prices are considerably higher in the major cities than the national average.

In terms of detached homes in Berlin, the comparatively low price level and high demand mean that the strongest growth in prices should be expected here. The price increase is predicted to be at 16 per cent, and thus above the national price development of 11 per-cent growth.

The future development of purchase prices depends on numerous factors. As long as interest rates remain low, property prices will continue to grow. However, the high current rate of inflation may cause the European Central Bank to introduce a more restrictive interest rate policy soon. The higher interest rate this would involve would limit the affordability of property for large swathes of the population and slow the growth in prices in the longer term. At the same time, policy-makers’ objective of climate neutrality will result in higher costs for new-builds and the adaptation of existing buildings. For this reason, the research institute and consultancy bulwingesa forecasts that the trend in increasing prices will continue.

Disclaimer: This article does not constitute tax or legal advice in individual cases. Please consult a solicitor and/or accountant to clarify the circumstances of your specific case.